Understanding who your customers are and how they behave is fundamental.

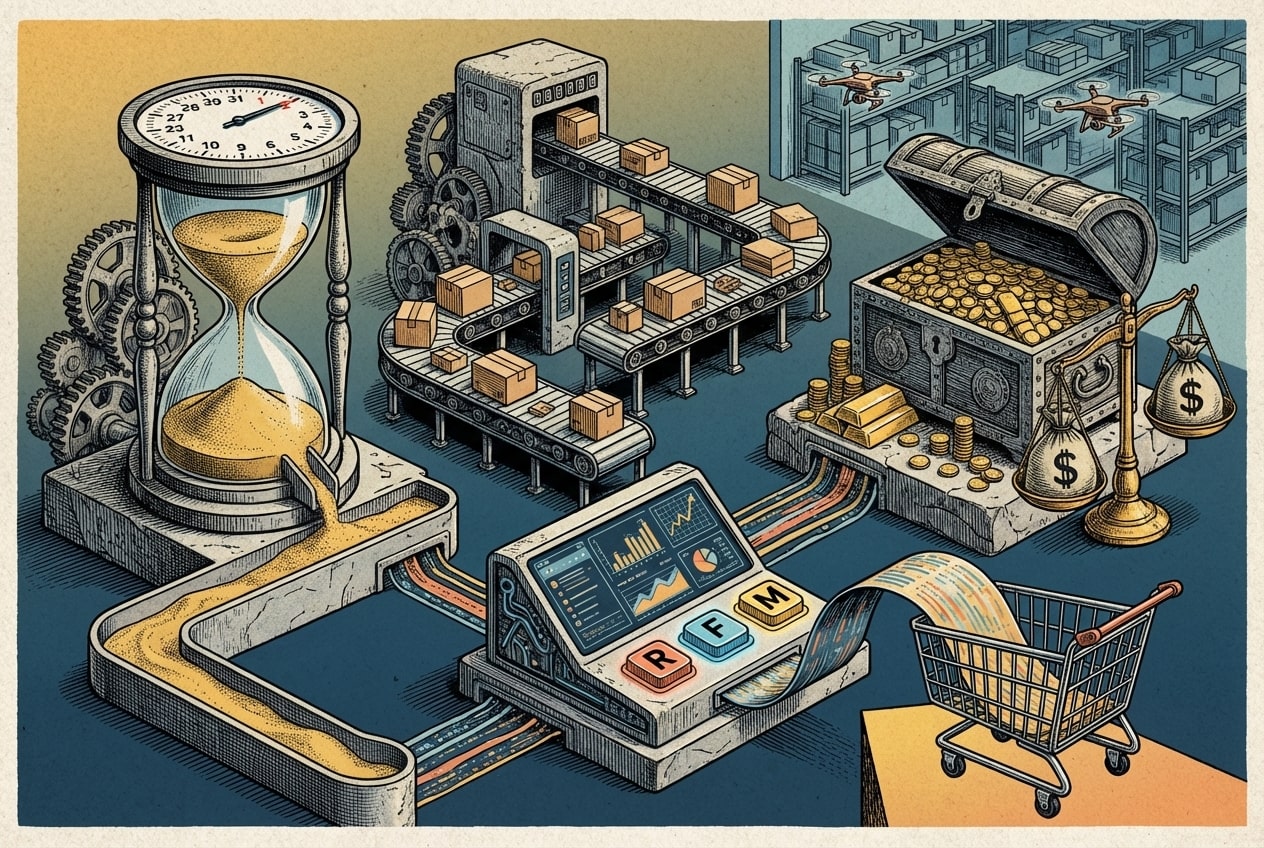

The RFM Matrix emerges as a powerful tool to uncover these behavioral patterns.

It helps us classify our buyers based on when they last purchased (recency), how frequently they buy, and how much they spend (monetary value).

In 2026, using RFM analysis is no longer a differentiator, but a necessity for those who want to stand out in e-commerce. Let’s understand how this matrix can transform the way your company relates to each customer.

Key Points of the RFM Matrix

- The RFM Matrix is based on Recency, Frequency, and Monetary Value to segment customers.

- Each metric (R, F, M) offers a unique view of customer purchasing behavior.

- Segmenting customers allows you to create more targeted and efficient marketing campaigns.

- Using the RFM Matrix optimizes marketing resources and improves return on investment.

- The analysis helps identify high-value customers and develop strategies to retain or reactivate different profiles.

Understanding the Pillars of the RFM Matrix

You know when you look at your customer base and think: “who are these people and what do they really want?” Well, the RFM Matrix comes into play precisely to solve that confusion. It’s a tool that helps us understand the purchasing behavior of people who buy from us, using three main points: Recency, Frequency, and Monetary Value. It’s like having an X-ray of the customer, you know?

What RFM Means: Recency, Frequency, and Monetary Value

Basically, RFM is an acronym for these three magic words:

- Recency (R): This metric looks at how recent the last time a customer made a purchase was. If someone bought yesterday, recency is high. If the last purchase was a year ago, recency is low. Simple as that.

- Frequency (F): Here we see how regularly the customer comes back to buy. Someone who buys every week has high frequency, someone who buys once a year has low frequency.

- Monetary Value (M): This part is about how much money the customer spent with you. Someone who spent $500 on a single purchase has a higher monetary value than someone who spent $50.

The Importance of Each Metric for Customer Analysis

Each of these metrics tells us a different story about the customer. Recency shows if they’re active and engaged at the moment. Frequency indicates the level of loyalty and how much they trust your brand. Monetary value shows who the customers that contribute the most financially to your business are.

Combining these three pieces of information gives us a very clear view of who is who in your customer base. It’s not just about who buys, but how and when they buy.

How Recency Influences Customer Engagement

Recency is one of the strongest indicators that a customer is interested in what you offer. Think about it: if someone just bought something, they’re likely more open to receiving new offers, seeing new products, or even participating in a satisfaction survey. Customers who bought a long time ago, on the other hand, may have forgotten about you or changed their preferences.

That’s why focusing on customers with high recency is a great way to keep engagement high and prevent them from falling into oblivion. It’s like saying “hello” to someone who just walked through your door, instead of shouting to someone who left a long time ago.

Structuring Your RFM Matrix for Success

For the RFM Matrix to really work and help you better understand your customers, you need to set it up in an organized way. There’s no point having a bunch of data if it’s not well arranged, right? It’s like trying to read a book with pages out of order.

Analysis and Organization of Existing Data

The first step is to take a good look at everything you already have about your customers. Think about your database, your CRM, anywhere you store purchase information. What do you need to extract from there? Basically, who the customer is, when their last purchase was (Recency), how many times they bought (Frequency), and how much they spent in total (Monetary Value). It’s important that this data is clean and standardized. If a customer appears with two different emails, for example, it’s good to merge everything into one place.

Defining Essential Parameters for Each Variable

After organizing the data, you need to define the limits for each metric. This will help assign the scores. For example, for Recency, you might decide that whoever bought in the last 30 days gets the maximum score, and whoever bought more than a year ago gets the minimum. For Frequency, maybe whoever bought more than 10 times in the last year is score 5, and whoever bought only once is score 1. And for Monetary Value, whoever spent more than $1000 might be score 5, and whoever spent less than $100, score 1. These numbers aren’t fixed, you adjust them according to your business and the general behavior of your customers.

Defining these parameters is what will set the tone for your entire RFM analysis. Think carefully about how you want to classify each customer within the three main metrics.

Calculating Each Customer’s Individual Score

With the data organized and parameters defined, it’s time to calculate each customer’s score. Generally, a scale of 1 to 5 is used for each metric (R, F, and M). So, a customer can have a 5-5-5 score, which would be the ideal customer, or 1-1-1, which would be a customer with low engagement on all fronts. You’ll take each customer’s data and compare it with the parameters you defined to assign these scores. For example:

| Customer | Last Purchase | Total Purchases (12m) | Total Spend (12m) | R Score | F Score | M Score | RFM Score |

|---|---|---|---|---|---|---|---|

| Ana Silva | 09/05/2026 | 12 | $850.00 | 5 | 4 | 4 | 5-4-4 |

| Bruno Costa | 07/15/2026 | 3 | $220.00 | 3 | 2 | 2 | 3-2-2 |

| Carla Dias | 08/20/2026 | 8 | $600.00 | 4 | 3 | 3 | 4-3-3 |

This individual score is the foundation for you to start segmenting your customers and thinking about specific strategies for each group.

Strategic Segmentation with the RFM Matrix

Now that we understand the pillars of the RFM Matrix, it’s time to get hands-on and use this data to divide your customer base into groups with distinct behaviors and needs. This segmentation isn’t just an academic exercise; it’s the foundation for creating marketing actions that actually work and don’t waste your time and money.

Identifying Champion and Potential Champion Customers

Customers who appear at the top of your RFM matrix, with high scores in Recency, Frequency, and Monetary Value, are your true treasures. They buy frequently, spend well, and do so recently. Think of them as your natural ambassadors. For these customers, the focus should be on keeping them happy and engaged. This might mean offering early access to new products, exclusive loyalty programs, or even inviting them to special events. They are the foundation of your business, so treating them like VIPs is an investment that pays off.

Strategies for Loyal and Promising Customers

Not everyone will be a ‘champion’, and that’s okay. We also have loyal customers, who may not spend as much as champions, but buy regularly. They are the backbone of your sales. For them, the ideal is to focus on increasing the average order value or purchase frequency. “Buy more, get a discount” campaigns or suggestions for complementary products (cross-selling) work very well here. Promising customers are those who show potential, perhaps with good frequency, but monetary value yet to be explored, or vice versa. A personalized approach, with offers that incentivize them to spend a bit more or buy more regularly, can turn them into loyal customers or even champions in the future.

Reactivating Inactive and At-Risk Customers

On the other hand, we have customers who are drifting away or who have already drifted away. Identifying who is at risk of churn is as important as taking care of your best customers. A low recency score, for example, may indicate that a customer hasn’t bought in a while. For these groups, the strategy changes. Reactivation campaigns with special offers, aggressive discounts, or even a simple contact to see if everything is okay can make a difference. The goal here is to regain attention and interest, showing that you care and that you have something new or interesting to offer. Sometimes, a small incentive is all they need to buy again.

RFM segmentation isn’t about creating rigid boxes, but about understanding nuances. Each group has distinct behavior, and your marketing actions should reflect that reality. Treating a customer who buys every day the same way as one who bought once two years ago is a waste of opportunity and resources.

Tangible Benefits of the RFM Matrix for Business

Implementing the RFM matrix in your business isn’t just about organization, it’s about making money work better for you. Think of it as having a detailed map of your customers, showing who the most important ones are and how they behave. This changes everything in how you spend your time and money on marketing.

Resource Optimization and Increased Marketing ROI

You know that feeling of throwing money away on campaigns that go nowhere? The RFM matrix helps avoid that. By segmenting your customers based on recency, frequency, and value spent, you can direct your marketing actions to the right groups. Instead of sending the same offer to everyone, you can create specific messages for each segment. This means your ads, emails, and promotions reach those who are really most likely to respond, increasing the chance of conversion and, of course, return on investment (ROI). It’s like using a target instead of shooting randomly.

Improved Behavior Prediction and Churn Prevention

Looking at your customers’ purchase history gives a huge clue about what they’ll do in the future. The RFM matrix, by analyzing when the last purchase was (recency), how often they buy (frequency), and how much they spend (monetary value), allows you to identify patterns. You can start noticing that customers who haven’t bought in a while and were spending little before tend to disappear. By identifying these signals early, you can act before they actually stop being your customers. This is churn prevention, meaning preventing them from going to the competition. It’s much cheaper to keep a customer than to acquire a new one, so this prediction is gold.

Increased Efficiency in Retaining Valuable Customers

Not every customer is equal, and the RFM matrix makes that very clear. It helps identify your most loyal customers who spend the most – those you want to keep close at all costs. For these “champion” customers, you can create exclusive loyalty programs, offer early access to new products, or simply send a special thank you. Small actions targeted at these valuable customers can make a huge difference in their loyalty. By focusing on those who already like your brand and spend more, you ensure they keep buying and, who knows, even spend more. It’s a virtuous cycle that strengthens your business.

Applying the RFM Matrix in Personalized Campaigns

Now that you know how to set up your RFM matrix, the next step is to use this information to create campaigns that really speak to your customers. There’s no point having all this data if it doesn’t translate into concrete actions, right? The idea here is to go beyond “hello, customer” and really show that you know who’s on the other side.

Directing Specific Content for Each Segment

Each group in your RFM matrix has a different behavior and expectation. “Champion” customers, for example, who buy a lot and recently, probably like novelties and feeling special. For them, an email with early access to launches or an invitation to an exclusive event can work very well. Those customers who bought a while ago, but with frequency and good value (the “loyal”), may respond well to loyalty programs or content that reinforces the brand’s value. Think about how purchase recency influences receptivity to new offers; someone who bought yesterday may be more open to a suggestion than someone who bought six months ago.

To segment effectively, we can think of some basic categories:

- Champions (High R, High F, High M): Most valuable customers. Offer VIP loyalty programs, early access to products, or event invitations.

- Loyal (Medium/High R, High F, Medium/High M): Customers who buy frequently. Incentivize them with progressive discounts or exclusive content about the brand.

- Potential Champions (High R, Medium F, Medium M): Recent customers with good potential. Offer cross-selling or upsell to increase value spent.

- At Risk (Low R, High F, Medium M): Customers who used to buy a lot, but stopped recently. Create reactivation campaigns with special offers.

- Hibernating (Low R, Low F, Low M): Inactive customers. Try one last reactivation offer or consider removing them from the active base to optimize resources.

Creating Tailored Offers and Incentives

With segmentation done, it becomes easier to create offers that really make sense. For customers who spend more (high M), a free shipping offer on purchases above a certain value can be a good incentive. For those with high frequency (high F), a points program that rewards each purchase may be more interesting. And for recent ones (high R), a “buy one, get one” offer can stimulate the next purchase. The secret is to make the customer feel that the offer was made for them.

| RFM Segment | Recency | Frequency | Monetary Value | Suggested Offer Type |

|---|---|---|---|---|

| Champions | High | High | High | Early access to launches, VIP programs |

| Loyal | Medium | High | Medium/High | Progressive discounts, exclusive content |

| Potential Champions | High | Medium | Medium | Cross-selling, upsell, first purchase offers |

| At Risk | Low | High | Medium | Aggressive discounts, reactivation campaigns |

| Hibernating | Low | Low | Low | Low-cost offer for reactivation, survey email |

Personalizing the Customer Journey Based on RFM

The RFM matrix doesn’t just serve for one-off campaigns, it can guide the entire customer experience. Imagine a customer who just made their first purchase (high R, low F, low M). The next communication with them could be a thank-you email with product usage tips and an invitation to follow on social media. If they come back to buy soon (increasing F), the communication can change to suggestions for complementary products. This continuous adaptation of the journey, based on the customer’s real behavior, is what builds long-term loyalty. It’s about understanding the moment of purchase and acting accordingly.

RFM-based personalization transforms raw data into meaningful conversations with your customers. Instead of sending the same message to everyone, you create stronger connections, increasing the chance of retention and customer lifetime value.

Visualizing and Interpreting Your RFM Matrix

After calculating Recency, Frequency, and Monetary Value scores for each customer, the next step is to make sense of these numbers. This is where visualization comes into play, transforming raw data into actionable information. Without good visualization, the RFM matrix can look like just a spreadsheet full of numbers, without a clear purpose.

Building the Matrix: Tables and Charts for Analysis

To start visualizing your RFM matrix, tables are a great starting point. They allow you to organize customers based on their combined scores. For example, you can create a table that lists customers and their R, F, and M scores, plus an overall RFM score. A common structure is to use a scale of 1 to 5 for each metric, where 5 is the best (most recent, most frequent, highest spend). The combination of these scores creates segments.

Charts can help understand the distribution of these segments. A bar chart can show how many customers fall into each segment (Champions, Loyal, Potential, etc.). A scatter chart, using Recency and Frequency as axes, with the point size representing Monetary Value, can reveal interesting patterns about which customers spend more and how often.

Interpreting Results for Decision Making

With visualized data, interpretation is what really makes the RFM matrix work. Each segment has distinct characteristics and behaviors that dictate the strategies to be applied.

- Champion Customers (high R, high F, high M): These are your best customers. They buy recently, frequently, and spend a lot. Keep them happy with exclusive loyalty programs and early access to new products.

- Loyal Customers (high R, high F, medium M): They buy frequently and recently, but maybe don’t spend as much as champions. Incentivize them to increase purchase value with upsell offers.

- Potential Customers (high R, low F, high M): They bought recently and spent well, but not frequently. Try to increase their frequency with targeted offers and reminders.

- At-Risk Customers (low R, high F, high M): They used to be good customers, but haven’t bought in a while. They need to be reactivated before they become lost.

The key to good interpretation is to look at the segments and think: “What does this group of customers really want or need?” The answers to this question will guide your actions.

Transforming Insights into Strategic Actions

The insights obtained from interpreting the RFM matrix must be translated into concrete actions. There’s no point knowing who your best customers are if you don’t do anything to keep them engaged or to improve the relationship with other segments.

- Personalize communication: Send emails with offers that match the purchase history and the value each customer spends.

- Create reactivation campaigns: Develop special promotions for customers who haven’t bought in a long time, but who were once frequent.

- Reward loyalty: Implement or improve loyalty programs that recognize and reward the most valuable customers.

- Optimize investment: Direct your marketing resources to segments that offer the greatest potential return, avoiding spending on low-value customers or those who have already left.

By correctly visualizing and interpreting your RFM matrix, you transform data into a map to guide your marketing and sales strategies, ensuring that each interaction with the customer is more effective and targeted.

Conclusion: The Power of the RFM Matrix for the Future

At the end of this journey through the RFM matrix, it’s clear that this tool is more than just a segmentation method; it’s a map for deeply understanding who your customers are and how to relate to them more intelligently. Implementing RFM in 2026 means taking a step forward, allowing you to create campaigns that truly speak each group’s language, optimize the use of your company’s resources, and most importantly, build lasting relationships with your customers. It’s not just about selling more, but about selling better, focusing on what really matters to each person. Start applying these concepts and watch your business grow in a more solid and connected way.

Frequently Asked Questions

What is the RFM Matrix?

Think of the RFM Matrix as a smart way to separate your customers into groups. It looks at three things: when they last purchased (Recency), how many times they purchased (Frequency), and how much money they spent in total (Monetary Value). With this, we understand who the most important customers are and how to talk to each one.

Why is using the RFM Matrix good for my business?

Using the RFM Matrix helps a lot! First, you clearly understand who your best customers are. This way, you can create promotions and messages they like more, making them buy more often. It also helps prevent losing customers who are disappearing and spending your marketing money where it gives the best results.

How do I segment my customers using the RFM Matrix?

It’s like giving grades to each customer! For Recency, whoever bought closest to today gets more points. For Frequency, whoever buys more times gets more points. And for Monetary Value, whoever spends more gets more points. By combining these scores, we can see who are the ‘champions’, the ‘loyal’ and other groups.

What types of customers does the RFM Matrix show?

We find several types! There are the ‘champions’, who always buy, spend a lot, and recently. There are the ‘loyal’, who buy a lot and spend well, but maybe not so recently. And there are the ‘promising’, who bought recently and can become loyal customers if we take care of them. There are also those who need a push or who are almost leaving.

How do I use this information to sell more?

It’s simple: talk to each group in a different way! For champions, create loyalty programs or ask them to refer friends. For those who are disappearing, send a special offer for them to come back. For new ones, send news and show how much you care about them. This way, everyone feels special!

Do I need special software to do the RFM Matrix?

Not necessarily! You can use spreadsheets or simple systems to organize your customer data. The important thing is to have information about when they bought, how many times, and how much they spent. With that data, you can already start to separate and better understand who your customers are.